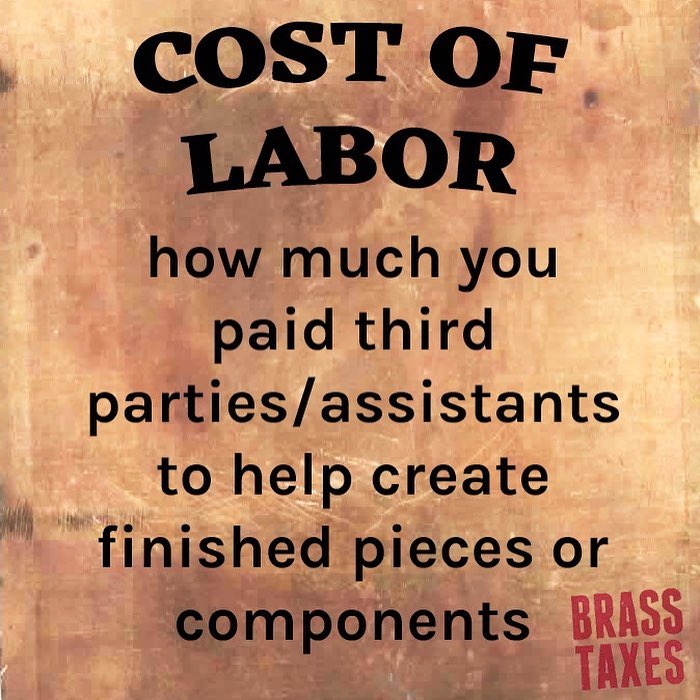

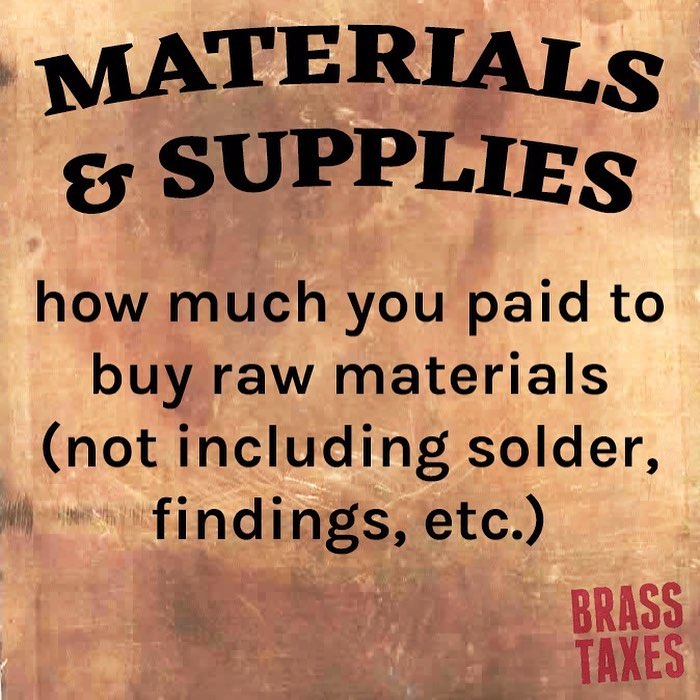

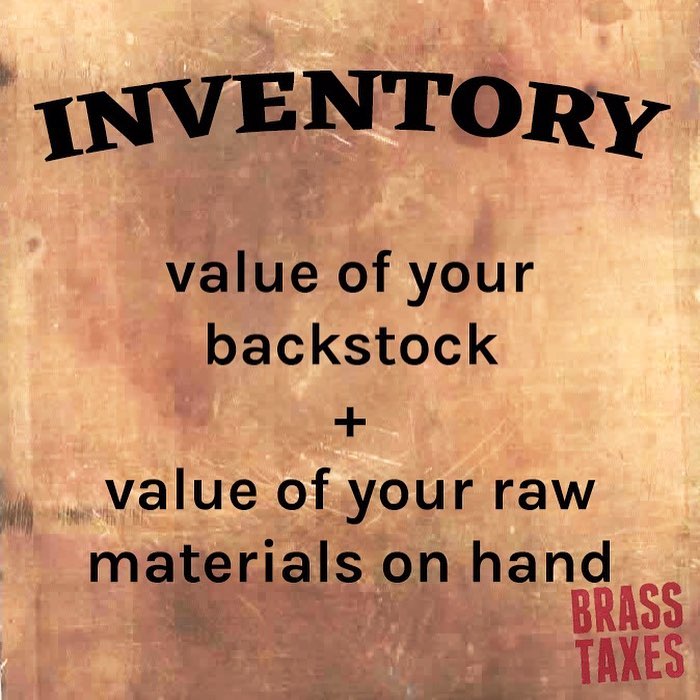

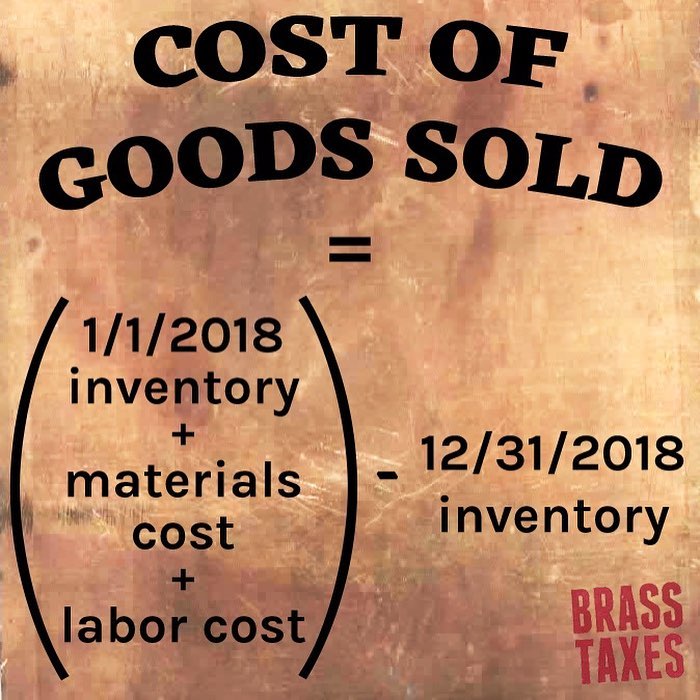

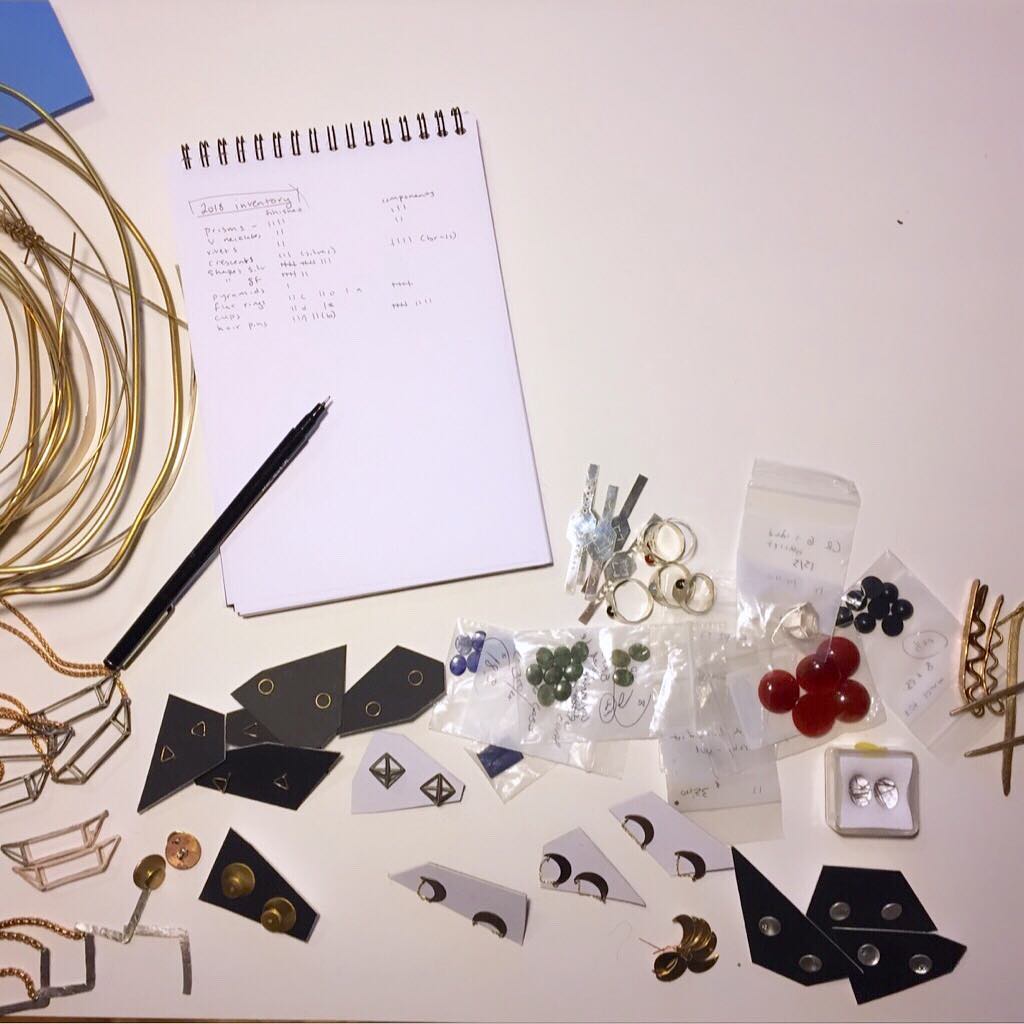

Here is some very helpful TAX INFORMATION for folks in the United States from @elisabethfuchsia, a jeweler & tax preparer at @brass_taxes - “We specialize in tax help for artists, freelancers, and other nice people. As jewelers, we have inventory & that goes in the tricky Cost of Goods Sold (COGS) section on the Schedule C (where you show the IRS your business income & expenses as a sole proprietor or single-member LLC). Here’s how that works: First, get a value for your backstock of both finished work & materials. Count things like your stock of metals/stones, but not findings & solder that you regularly use up in a year (that stuff goes in the Schedule C category “Supplies”). That total is Ending Inventory this year & Beginning Inventory next year. Use the price you paid, not what you'd sell them for, since this is about tracking expenses, not finished value. The Cost of Labor piece of COGS is what you paid other people to help you create work (i.e. caster, setter). Using these totals, COGS takes Ending Inventory out of the sum of your Beginning Inventory + Cost of Labor + Materials & Supplies (cost of metal/stones you bought this year). In other words, we take the value of what you had on 1/1, add what you put in during the year, and subtract the value of what you had left on 12/31. This finds the cost of what you sold this year, so you can take that expense against this year’s income & take the expense for what’s left in your backstock when you sell it in the future. For a tricky example, if you melt down a ring from 2017 to make a new piece in 2018, it won’t change these numbers: you accounted for material cost in 2017 & that expense has already traveled to 2018 in Beginning Inventory.

This is how it should work, but if you haven’t done it this way, talk to your tax preparer about it to figure out what’s best for you. This stuff gets confusing and complicated but doing your taxes doesn't need to suck so much. If you need help, we're offering $25 off your return price with the code "Metalsmith Society." DM @brass_taxes for help!”

Thank you so much for breaking this down and if anyone has follow up questions 🙋♀️ please feel free to ask! #metalsmithsociety